With prices and interest rates Increasing, have I missed my opportunity to invest in multifamily?

As you may be aware, the multifamily market is hot. Investor demand for rental properties in the last few years fueled by low interest rates, wage and job growth, increasing rent and decreasing vacancy has driven up the price of this real estate sector. According to Real Property Analytics, as of February 2022, the price of multifamily commercial real estate increased for 17 consecutive months before it finally slowed between February and March this year.

In addition, the cost of financing has increased. The federal funds rate has increased by .25% since the beginning of the year with the Fed indicating that it will increase rates several times this year.

You may be asking yourself, with advent of substantial inflation and the increasing interest rates, is this a bad time to invest?

The consensus in the industry appears to be “no.”

According to the Freddie Mac 2022 Multifamily Outlook, despite the high inflation seen throughout 2021, rent growth was more than sufficient to eclipse the high inflation rate and higher expenses. Looking forward to 2022, both inflation and rent growth are expected to moderate, but rent growth is expected to increase and outpace inflation for most metros. According to a CBRE 2022 U.S. Investor Survey, strong investor sentiment continues despite concerns about inflation, interest rates and the COVID pandemic.

While the market is experiencing these headwinds, there are several reasons that investors remain bullish on the sector. This is evidenced by the continued flow of investment into the space and not just the Sunbelt states that get so much press, but there are new sources of capital entering the Midwest chasing multifamily product according to Parker Stewart, managing director in the Chicago office of Northmarq.

Investors are still anticipating a solid 2022 for multifamily investment, but one that might include lower profit margins than 2021, according to Lightbox’s Q1 2022 Investor Sentiment Report.

In addition to the ever present Five Reasons to Invest in Multifamily, the following considerations reflect that multifamily remains a highly desirable investment in today’s economy.

Demand Remains Strong

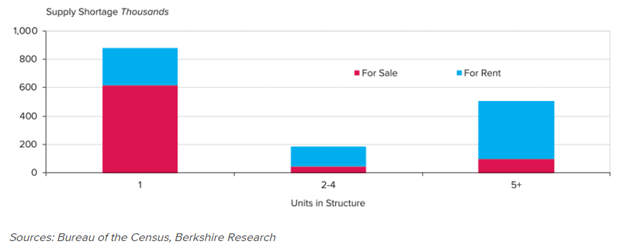

1. Housing sector is substantially under built

It is estimated that that housing is underbuilt by as 2 million units with approximately one half of those consisting of rental units.

For example, Los Angeles is conservatively estimated to have a shortage of at least 10,000 units, Inland Empire, a shortage of 8000 units and San Francisco a shortage of 5000 units. This phenomenon is not limited to the coasts. Smaller Midwest cities such as Columbus, OH, Cincinnati and Indianapolis are experiencing housing shortages as well.

2. Employment Growth Driving Household Formation and Demand

In addition to the existing housing shortage, Fannie Mae is forecasting additional demand for rental units due to national employment growth of 2.8% this year. Even in cities where the forecasted employment growth is lower than the forecasted national growth rate, these metros are not expected to have enough new multifamily supply to meet potential for demand. For example, Indianapolis has a projected job growth rate of 2.5% which could produce demand for 4000 additional rental units with fewer than 1800 multifamily units expected to be delivered this year.

Even with construction activity increasing, it is nevertheless hampered by supply chain and labor issues. According to the National Multifamily Housing Council Construction Survey, more than 98% of respondents reported that their projects were being impacted by lack of materials, 100% are dealing with price increases for material and 88% impacted by the availability of labor.

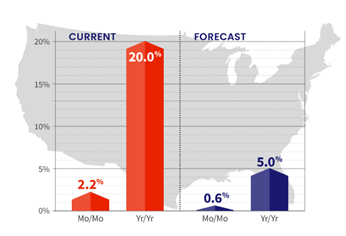

3. Increased Cost of Home Ownership

The dramatic increase in home prices is also likely to contribute to the demand for rental units. According to CoreLogic, home prices nationwide increased by 20% from February 2021 to February 2022. increases are forecasted to continue but at a more modest rate.

Zillow is forecasting an average increase of 11% in 2022.

4. Continued Rent Growth

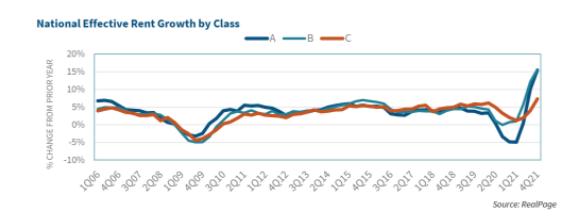

National rent growth in 2021 reached 10% with several metro areas experiencing rent increases ranging from 23% (Austin) to 31% (Sarasota). Rent growth is projected to continue but at a more modest level (i.e., 4% to 5%) through 2022.

5. Continued High Occupancy Levels

Nationally, the multifamily vacancy rate of 5% is expected to continue while rents are forecasted to continue to increase. This is expected to be driven by limited new housing supply and an expected increase in rental demand stemming from improving employment trends and the increased cost of home ownership.

6. Hedge Against Inflation

In addition to the high demand for housing, low inventory and strong fundamentals, investment in multifamily real estate can serve as a hedge against inflation.

First, owners benefit from appreciation in the value of their tangible assets (e.g., real estate) during an inflationary period. Second, rents increase during an inflationary period, which increases revenues and cash flow which in turn increases property value. For example, the apartment rental rate growth in October 2021 was 7.5% higher than the annual increase in consumer prices reported that month (13.7% vs. 6.2%). Third, if the property is financed using debt with a fixed interest rate, the holding costs do not increase over time (even while rent is increasing). Moreover, inflation reduces the value of the money owed in the future.

Historically, real estate has generated higher returns than publicly traded stocks or bonds during periods of inflation. High inflation can erode the buying power return of interest on bonds and create volatility in the stock market.

Strong economic conditions, along with historic high levels of demand for multifamily housing created robust apartment market conditions in 2021. While there are still some uncertainties in the market, such as increasing inflation or variants of the COVID-19 virus that could slow economic conditions, the multifamily apartment market is expected to be on solid ground in 2022.