In a nutshell, the five major benefits of real estate investment over an investment in the stock market are:

1. Cash flow

2. Tax benefits

3. Leverage

4. Increase equity through debt amortization

5. Stability/lack of volatility

1. Cash flow

Unlike the stocks, mutual funds and bonds that most of us invest in, real estate investments can provide meaningful cash flow while increasing in value. For investors looking for another stream of income, the stock and bond market are not the answer. If you are like most of us, your stock investments do not generate meaningful cash flow.

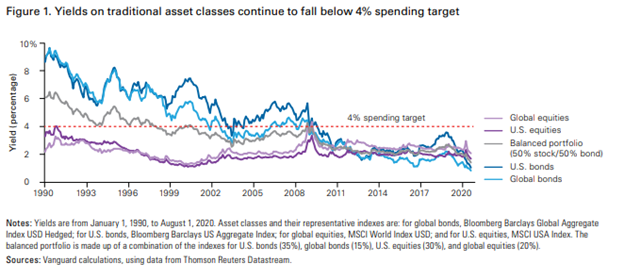

In the past, as illustrated below, a broadly diversified portfolio of equity and fixed income investments could generate a yield equal to 4% or 5% of the portfolio’s value, consistent with conventional guidelines for retirement spending from a portfolio. Today, that is no longer the case.

By contrast, investments in multifamily real estate can provide cash flows of 5-7% (or more) on your investment plus appreciation in the value of the underlying investment that will be received when the property is sold.

2. Tax benefits

Investors in real estate enjoy tax benefits that investors in stocks and bonds do not and certainly that wage earners do not. The Federal government permits real estate investors to take tax deductions for the cost of their investment over time. Without going into detail, the effect of taking these tax deductions is that investors do not pay tax on the cash flow in the years that they receive it. While these taxes will ultimately be payable when the investment is sold, the taxes are at a lower rate than would have applied to cash flow received previously. So real estate investors can defer their tax and then pay tax at a lower rate when the tax is ultimately paid.

In addition, investors may be able to defer the tax on the profits when a property is sold if they invest sales proceeds into a new property in what is known as a “like-kind exchange” also known as a “1031 Exchange.”

3. Leverage

By using borrowed money, investments in real estate give investors the ability to multiply the returns they would otherwise receive in traditional investments such as securities, mutual funds and bonds. Investors can borrow money to make a real estate investment unlike investments in stocks and bonds. The use of this borrowed money permits investors to reap the return on an asset of larger value.

For example, if you had $100,000 to invest and you invested it in the stock market at a 5% return, after 5 years (assuming no compounding) you will have earned $25,000. If you took that same $100,000 and borrowed $300,000 at 3% interest and invested the $400,000 in real estate at the same 5% return, after 5 years you would have $55,000 (i.e., $400,000 x 5% =$20,000 x 5 years is $100,000 minus the interest on the loan ($300,000 x 3% x 5 years = $45,000).

4. Principal reduction

The principal of the debt used to acquire investment real estate is paid using rent received from the tenant residents who rent or lease the property. Consequently, the debt is paid down and the value of the investment steadily rises without any additional cash expenditure by the owner. When the property is ultimately sold, the value of that mortgage paydown goes to the investors which further increases the return on investment.

To illustrate this point, assume that you invested $100,000 cash and $300,000 of borrowed money into a property and leased the property for just enough rent to pay the mortgage and the expenses, so that there was no additional out of pocket expense. After the mortgage is paid, if the property is sold for the same amount for which it was purchased, you would receive $400,000, or a $300,000 profit and that is assuming that the property did not appreciate in value. That entire profit is from someone else paying the mortgage on your property!

5. Stability/lack of volatility

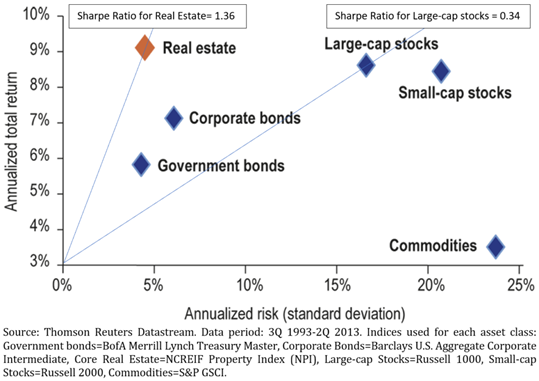

Historically real estate has been less volatile than the stock market. Real estate, unlike the stock market, is not subject to daily volatility events of the stock and bond markets and out of control of investors (such as in European debt crisis in 2012) [?] See the graph comparing the risk versus return for various asset classes. You will see that real estate risk is only slightly higher than government bonds but had a historical return as high as any of the asset classes. It is notable that the 20-year period reflected in this graph includes the burst of the dot com bubble and the 2008 debt crisis.

Real estate investments also provide the benefit of appreciation in value, but so do stocks (and bonds to some degree) and for that reason, appreciation is not listed as an advantage of a real estate investment over a stock market investment. Although unlike a stock market investment, there is the ability to “force” appreciation with real estate. By making improvements to a rental property, the owner can demand higher rent and since a buildings value is based on how much income it generates, the owner has created or forced appreciation by making these improvements (rather than waiting for the impact of market forces).

All of these advantages, cash flow, tax benefits, leverage, principal reduction, stability and appreciation can be obtained by investing passively, just like in the stock market. You don’t need to find a house or an apartment building and rent it and repair it yourself. You can invest in a partnership (a syndication) where the general partner does all of that work and the benefits flow through the partnership to you (or to your IRA – yes you can invest through your IRA!).

If you are interested in learning more about investment opportunities with us, please click on the button below and we will send you an email which will give you the option of applying to learn about future investment opportunities.

Pingback: Multifamily Investing in an Inflationary Environment – Venture60

Lick your way down http://tiny.cc/gz35vz